As you know from my past few posts I’ve been reading Lowell Miller’s The Single Best Investment: Creating Wealth with Dividend Growth. One thing that surprised me a bit was his comments about inflation. The author pointed out that the 60 year average inflation rate in the United States is 4.1%. The book was written 8 years ago in 2006 and has a US focus, so I decided to do some of my own research to see if this figure was still accurate.

What is inflation?

Before I dive into the results, I want to explain what inflation is. Investopedia defines inflation as

“The rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.” […] “As inflation rises, every dollar will buy a smaller percentage of a good. For example, if the inflation rate is 2%, then a $1 pack of gum will cost $1.02 in a year.”

The Bank of Canada website has an inflation calculator that you can play around with to get an idea of how inflation affects your purchasing power. Here are a few of my results:

As you can see inflation over a long period of time has a significant affect.

Why inflation is important to dividend growth investors

Dividend growth investors who want to live off of their dividend income in retirement should be aware of inflation because their retirement expenses will cost more in the future. By investing in dividend growth stocks with dividend growth rates higher than inflation you are able to protect your purchasing power. This is just one reason why I love dividend growth stocks.

In order to protect your purchasing power it is important to invest in companies with dividend growth rates above inflation. Trying to guess what will happen in the future is impossible, but you can still make an educated guess based on historic inflation rates and central bank targets.

Central bank target inflation rates

Most countries today will try and target an inflation rate of 2-3% because this rate is considered beneficial for the economy. In the United States the Federal Reserve tries to “maintain an inflation rate of 2 percent over the medium term”1. This is similar to the Bank of Canada which “aims to keep inflation at the 2 per cent midpoint of an inflation-control target range of 1 to 3 per cent.”2

Historic inflation rates

It’s all well and good to have a target, but there are so many different factors that affect inflation that it becomes unrealistic to think that inflation will always be at the target rate. If you look at the annual inflation rates going back to the 1950s for Canada and the United States you’ll see that they have fluctuated quite a bit.

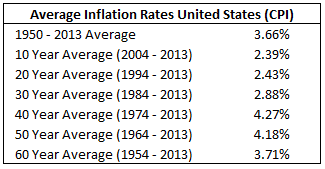

One noticeable trend is that the last 20 to 30 years have been much more stable than before that time. Looking at the 10, 20 and 30 year average inflation rates for both Canada and the United States in the tables below show that for the most part inflation has averaged around 2-3%. When you start looking at longer averages the rates increase to around 4%.

For Canada the 60 year average is 4.06% and for the United States it is 3.71%. These are pretty close to the 60 year 4.1% average inflation rate mentioned in the 2006 edition of Lowell Miller’s The Single Best Investment: Creating Wealth with Dividend Growth. I like to be conservative in my estimates, so while in the past 20 to 30 years inflation has been around 2-3%, I prefer to use the longer term average of 4%.

How inflation affects your minimum dividend growth target

A lot of dividend growth investors want dividend growth from their investments to grow at or above inflation rates. With this approach they are able to protect their purchasing power, so come retirement their dividend income can support their expenses. With this in mind you would think the minimum dividend growth target would be 4%, but I prefer 6% as it gives you a bit of an extra cushion.

Say you invest in a company and dividend growth is projected at 6%. Fast forward a year and some negative event has occurred that the company has to recover from. Consequently their dividend growth ends up being lower than projected. With a target of 6% you have some extra room for those unexpected events. This is why 6% is my minimum dividend growth target.

In my portfolio I try and target 8% dividend growth, but I’ll still invest in a company if dividend growth is projected at 6%. As with most things in life, investing isn’t black and white and I find some flexibility is necessary. This is why I try and target 8% dividend growth, but will go as low as 6%. In a balanced portfolio you will have some companies that have high dividend growth in some years while others have lower growth. My goal is to average 8%. A good example of an instance where I’d accept 6% is a company with a high dividend yield. With these targets I feel like it provides good protection against inflation while also providing solid compounding returns.

How do you approach inflation in your portfolio?

Footnotes

The post How To Combat Inflation With Dividend Growth And Protect Your Purchasing Power appeared first on Dividend Growth Investing & Retirement.