I’m always on the lookout for dividend growth companies that have long growing dividend streaks, wide economic moats and strong financial strength. I plan to buy these companies at cheap valuations and utilize the growing dividend income to become financially independent. One characteristic of a good dividend growth company is the ability to pay increasing dividends because it is also increasing its earnings. Dividend growth without earnings growth is not a sustainable long term trend. As I plan to invest and hold on to these companies for a very long time, it is important to me that they are able to regularly make more money to support the increasing dividend. With that in mind I decided that I would try and identify companies in the Canadian Dividend All-Star List that have been able to increase their earnings per share (EPS) at a consistently high growth rate over the past decade.

Related: Canadian Dividend All-Star List Free Download Page

To start with I used Morningstar annual EPS data for a decade found in its Key Ratio tab for each company in the January 31, 2015 version of the Canadian Dividend All-Star List [Excel download here]. Morningstar only shows 10 years’ worth of data, so depending on the year end of the company I was able to collect data from 2004 to 2013 or 2005 to 2014. A lot of companies have a December 31st year end and haven’t reported 2014 results yet so where the year-end is December 31st then EPS data from 2004 to 2013 was used. If the company had a different month as a year-end then 2005 to 2014 data was used. I wanted to find out which companies were able to make more and more money each year, but also increase earnings at a high rate so I used two sets of criteria to come up with a ranking: High EPS Growth and Consistent Earnings Growth.

High EPS Growth Ranking

Using the Morningstar information I calculated the 9 and 5 year EPS Compound Annual Growth Rate (CAGR). For the math nerds reading this; here is an example the formula I used to calculate the 9 year EPS CAGR for a company that had EPS data from 2005 to 2014:

[(2014 EPS/2005 EPS)^(1/9)]-1 = 9 Yr EPS CAGR %

I’m interested in companies with high EPS growth to support high dividend growth so I screened the results for companies with a 9 and 5 year EPS CAGR of 8.0% or higher. If both rates are 8.0% or higher they are rated with a “Y” (Yes), if not they get an “N” (No).

Consistent Earnings Growth Ranking

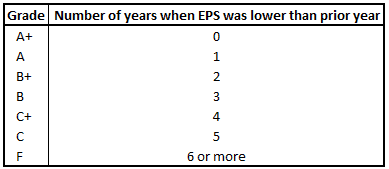

Next I wanted to see which companies were able to regularly make more money than the previous year. I looked at a decade’s worth of data. If the year-end month was December then I looked at EPS data from 2004 to 2013, otherwise the data was from 2005 to 2014. Looking over the annual EPS for the decade I counted the number of times that EPS was lower than the prior year and then graded them.

As you can see from the table, companies which have consistently grown their EPS compared to the previous year receive a higher grade. I’ve also included a few examples below so you can better understand the grading system. Amounts highlighted in red are years where EPS was less than the prior year.

The Results

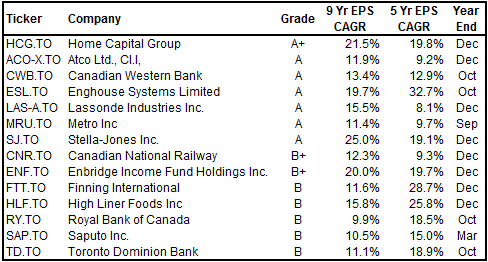

Of the 94 companies (61 in the “Canadian Dividend All-Star List” tab and 33 in the “Others” tab) in the January 31, 2015 version of the Canadian Dividend All-Star List; 14 had a Consistent Earnings Growth Ranking of a B or higher and a 9 and 5 year EPS CAGR of 8.0% or higher. Drum roll please…

This is a pretty decent looking group of companies. One thing I found interesting was that there was only one company that was able to make more and more money year after year: Home Capital Group [HCG.TO Trend]. I plan to do a bit more research on the company as its low dividend yield has kept me on the sidelines in the past. If you look at the table below you’ll notice that a low dividend yield is a common trait among these companies, especially the higher the grade.

Another common trait is that all these companies have high dividend growth rates with the exception of Enbridge Income Fund Holdings [ENF.TO Trend]. This makes sense because they have been able to grow earnings at a high rate over the past decade, so I’d also expect dividend growth to be high.

As a dividend growth investor I like to invest in high yield and high growth. Most of these companies have low dividend yields, which have kept me from investing in them. That said, I like to be aware of these high growth low dividend yield companies so that when they go out of favor and the dividend yield jumps above its historic norms I can pick up shares on the cheap.

I added the 3, 5 and 10 year highest yield averages so you can get an idea of what the historically high dividend yield looks like for these companies. It seems to be around the 2.0% to 2.5% dividend yield mark for those with an A or A+. If you can get into these stocks at the 2.5%-3.0% range or higher and they continue their strong dividend growth you can do quite well in the long run. This was one of the reasons I decided to buy Canadian Western Bank [CWB.TO Trend] back in December 2014.

Related Article: Canadian Western Bank Dividend Stock Analysis, Toronto Dominion Bank Dividend Stock Analysis & Royal Bank of Canada Dividend Stock Analysis

You start to see a few higher yielding stocks near the bottom of the chart. Toronto Dominion Bank [TD.TO Trend] and Royal Bank of Canada [RY.TO Trend] stick out. It’s hard not to be overweight in financials as a Canadian dividend growth investor because the Canadian banks typically offer high dividend growth and a high dividend yield. A few more banks pop up in the honorable mentions below too.

Honorable Mention

There were a few companies that were a little shy of the earnings growth criteria that I thought should be included as honorable mentions. Here they are:

Canadian Tire [CTC-A.TO Trend] and Computer Modelling Group [CMG.TO Trend] just missed the cut and the other are pretty close too. Rogers Communications [RCI-B.TO Trend] had negative EPS in 2004 and 2005 so the 9 Yr EPS CAGR couldn’t be calculated, but the 7 Yr EPS CAGR is 18.7%.

Related Article: Rogers Communications Dividend Stock Analysis

Final Thoughts

I started with the 94 companies in the Canadian Dividend All-Star List and was surprised to find out that only one company got an A+. I know there are a lot of other Canadian companies out there, that don’t make it on to the Canadian Dividend All-Star List, so I wonder if there are other companies that would have scored an A+. If you find one, let me know.

All-in-all I think the list is a good filter for quality companies and it unearthed some new names that I plan to do a bit more research on. What are your thoughts on the companies shown and the ranking system?

The Whole List

If you are like me and like to play around with spreadsheets feel free to dig in. Below is the whole list. There is a lot of data, so you’ll have to scroll to the right to see it all. Enjoy!

FYI and Deficiencies

I used EPS to analyze these companies, but in some cases this isn’t really the best measure to use. For instance REITs and Income Trusts typically use Funds From Operations (FFO) or Adjusted Funds From Operations (AFFO). Because I used EPS in all cases, the information for REITS and Income Trusts may not be as valuable.

I used EPS data from Morningstar and did not double check the data to another source, so there could be data integrity issues. Finding reliable data for a 10 year period for 94 companies is difficult. This was meant as a quick and dirty list, so if you spot any mistakes let me know and I’ll update the list. For the most part I expect it to be accurate, but would not be surprised if the odd mistake existed.

In some cases the EPS CAGR could not be calculated because the company had negative EPS or the company did not have 10 years’ worth of EPS data, so “n/a” was used instead.

Keep in mind that dividend information was taken from the January 31, 2015 Canadian Dividend All-Star list, so information like the dividend yield is based on the stock price of last trading day of the January, which was the 30th.

I think these lists provide a good starting point for further research, but as always do your own due diligence before investing. As of the time of writing I own Canadian Western Bank, Ensign Energy Services, Rogers Communications and Suncor Energy. You can see my portfolio here.

Photo credit LendingMemo / Foter / CC BY

The post 14 Canadian Dividend Growth Companies with Consistently High Earnings Growth appeared first on Dividend Growth Investing & Retirement.