Want to double your dividend income in 10 years?

Invest in dividend growth stocks that average +7% dividend growth per year.

Want to triple your dividend income in 10 years?

Add in dividend reinvestment with a reasonably high starting dividend yield.

A portfolio yielding 5% with +7%/year dividend growth will roughly triple its dividend income after 10 years if dividends are reinvested.

Before we get into the compounding powers of dividend reinvestment, let’s look at a “double your dividend income” example.

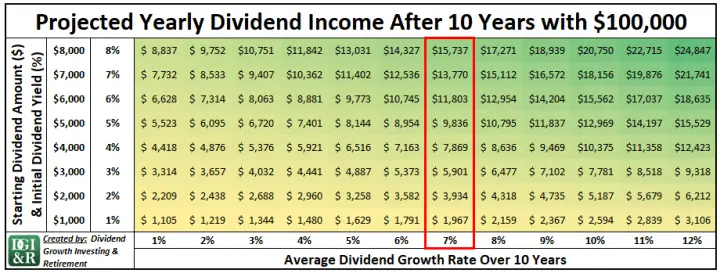

How to double your dividend income with $100,000

Let’s say you have $100,000 and you invest it in dividend growth stocks that initially yield 4%.

To start, your annual dividend income is expected to be $4,000 ($100,000 x 4%).

Over the next 10 years, dividends in your portfolio grow at 7%/year on average.

Your dividends grow from the initial $4,000/year to $7,869/year after a decade.

Ok, so 7% dividend growth doesn’t quite double in 10 years, but you get close.

You’d actually need an average of 7.2%/year dividend growth to double your dividend income in 10 years.

Using the same $100,000 portfolio example with a 4% yield and 7.2%/year dividend growth would mean projected dividends of $8,017/year after 10 years.

Bottom line

At 7% average dividend growth, projected dividends will almost double after 10 years.

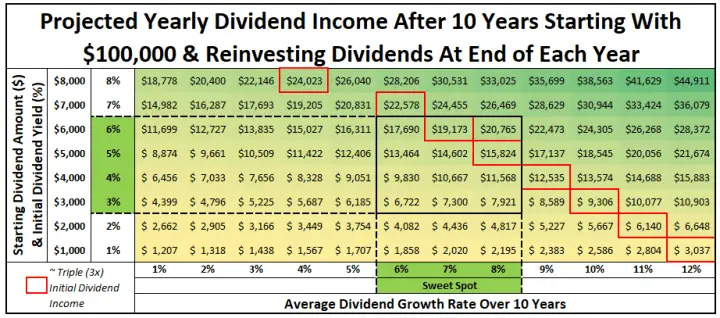

From the table above you can see that regardless of your starting yield, projected dividends almost double after 10 years so long as the dividend growth is 7%.

A $100,000 portfolio that has a 2% yield starts with $2,000/year in dividend income and grows to $3,934 after 10 years with 7% dividend growth.

An initial yield of 6% starts with $6,000/year and grows to $11,803 over 10 years.

And so on and so on…

So if you want to double your dividends in 10 years, make sure your dividend growth is over 7%.

Sounds simple enough, but it’s harder in practice if you want a reasonable starting yield.

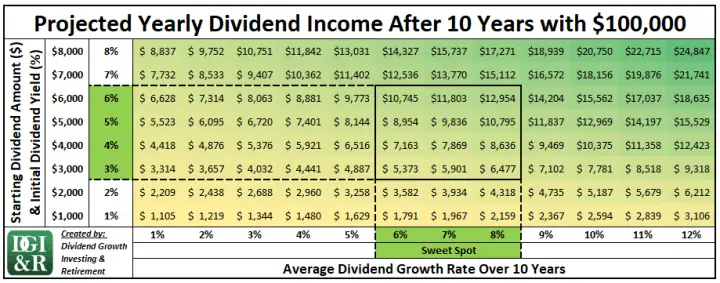

The Sweet Spot: 3-6% Dividend Yield With 6-8% Dividend Growth

I’ve found the sweet spot is a yield in the 3-6% range with 6-8% dividend growth.

Low Yield (<3%) = Not enough dividend income even with high dividend growth

If the yield is too low (<3%), then dividend income even after a decade of high dividend growth is still too low to live off of.

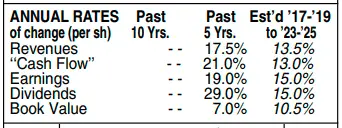

Visa (NYSE:V) Example

For example, I’m pretty sure Visa (NYSE:V) will be able to grow dividends at a high rate over the next 10 years, but its yield is really low.

As I write this, the yield is only 0.6% and Value Line is estimating 15%/year dividend growth over the next 3-5 years.

Source: Visa Value Line Annual Rates Table November 6, 2020

Let’s say you invest $100,000 in Visa and it grows its dividend at 15%/year for the next decade.

In 10 years’ time, your projected annual dividends will have grown from the initial $600/year to $2,427.

In other words, over 10 years the yield on cost had grown from the very low 0.6% to the still low 2.4%. For most retirees, this low income isn’t going to be enough.

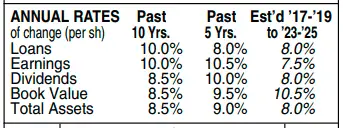

Toronto-Dominion Bank (TSE:TD; NYSE:TD) Example

Compare this with Toronto-Dominion Bank (TSE:TD; NYSE:TD) which at the time of writing yields 4.5% and Value Line is estimating 8% dividend growth per year for the next 3-5 years.

Source: Toronto-Dominion Bank Value Line Annual Rates Table November 6, 2020

If TD manages to grow its dividend by 8%/year over the next 10 years your projected dividends on a $100,000 investment will have grown from $4,500/year to $9,715.

Even though Visa had a much higher dividend growth rate, TD’s dividend income after 10 years is still 4 times that of Visa’s.

Remember, these are just examples to illustrate a point, please don’t go out and buy $100,000 of just one stock.

The idea is to build a diversified portfolio with dividend growth stocks that fall within the sweet spot of 3-6% yield with 6-8% dividend growth.

High Yield (>6%) = Risk of Dividend Cuts & Unreliable Dividend Safety

If the starting yield is too high (>6%), then it’s a sign the company might cut the dividend or future dividend growth will be low.

There can be exceptions to this of course, but if you are looking for reliable dividend income in retirement, don’t go yield chasing.

You don’t want to be worrying about the dividend safety of your investments if the plan is to live off that dividend income.

The Sweet Spot: Not too hot, not too cold, just right …

I want a mix of high, but not too high yield and reasonably high dividend growth.

My sweet spot for dividend growth is 6-8% because it’s a reasonably attainable goal for stocks yielding 3-6%.

Sometimes you’ll be able to find stocks with higher yields and dividend growth rates, but just make sure the dividend is safe.

After all, there is no free lunch in finance.

Ultimately there is a trade-off between dividend yield and dividend growth.

- Most high dividend growth (+10%) stocks have very low yields.

- Most stocks with high dividend yields have very low or no dividend growth, and some will cut their dividend.

My sweet spot is all about finding safe and reliable dividend growth stocks with the right balance of dividend yield and dividend growth.

Hopefully, these examples and this table can help you find your own sweet spot as you plan out your retirement.

How to Triple your Dividend Income with Dividend Reinvestment

I mentioned at the beginning of the post that a portfolio yielding 5% with +7%/year dividend growth will roughly triple its dividend income after 10 years if dividends are reinvested.

Well, it’s not the only way to do it.

In the table below I’ve highlighted in red the different dividend yields and growth rates you’d need to triple your projected dividend income after a decade.

Image may be NSFW.

Clik here to view.![Annual Dividend Income After 10 Years with $100,000 and Dividend Reinvestment Sweet Spot & Triple Your Income Table]()

5% Yield, 8% Dividend Growth & Dividend Reinvestment Example

Step #1: You invest $100,000 in dividend growth stocks that yield 5% and grow dividends at 8%/year.

Step #2: You reinvest dividends at the end of each year back into more 5% yield, 8% dividend growth companies.

Step #3: Wait 10 years.

Results: After 10 years, you will have more than tripled your initial $5,000 in dividends. In fact, at the end of 10 years, your portfolio will pay out $15,824 in dividends.

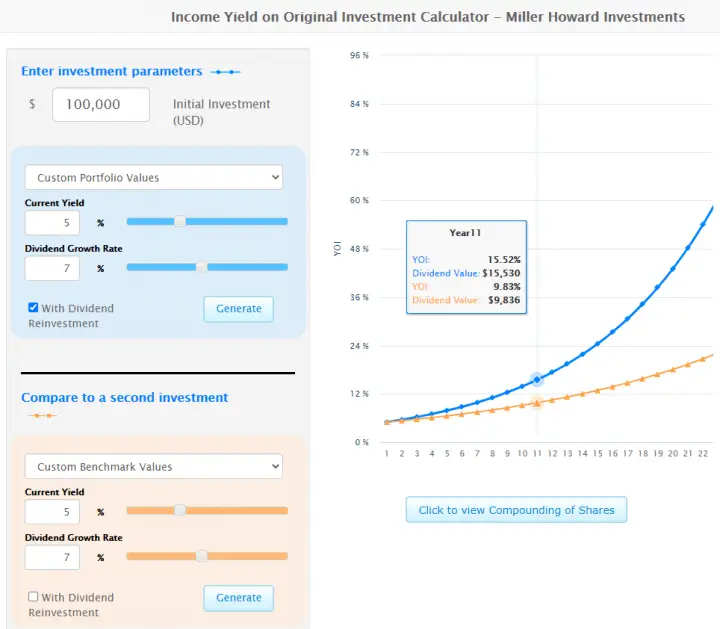

A Useful Tool: The Income Yield on Original Investment Calculator

While researching for this article, I stumbled across the “Income Yield on Original Investment Calculator” from Miller Howard Investments.

I hope that you find the tables in this article useful, but if you are looking for something more interactive you should use the “Income Yield on Original Investment Calculator“

5% Yield & 7% Dividend Growth: With & Without Dividend Reinvestment

Here’s a screenshot of what $100,000 with 5% yield and 7% dividend growth looks like:

- without dividend reinvestment = orange line, and

- with dividend reinvestment = blue line.

Source: Miller Howard Investments “Income Yield on Original Investment Calculator“

In the chart above you see that at the end of year 10 (Shows as the beginning of Year 11 in this tool):

- Dividend income without dividend reinvestment would be $9,836 (orange line), which is almost double the $5,000 dividend income you start with.

- Dividend income with dividend reinvestment would be $15,530 (blue line), which is more than triple the $5,000 dividend income you start with.

I noticed that my dividend reinvestment tables don’t exactly match the tool above, but I think it’s because in my tables I’m reinvesting the dividends once a year and in the “Income Yield on Original Investment Calculator” I think they reinvest every quarter (4 times a year).

Summary

Want to double your dividend income in 10 years?

Invest in dividend growth stocks that average 7.2% dividend growth per year.

Use this table to see what the dividend income on $100,000 will grow to in 10 years’ time depending on the initial yield and dividend growth rate.

Want to triple your dividend income in 10 years?

Add in dividend reinvestment with a reasonably high starting dividend yield.

The boxes highlighted in red show you what dividend yield and dividend growth rate you’d need to triple your income after 10 years.

Hopefully, you find these tables useful as you plan out your retirement, but remember to focus on the sweet spot of 3-6% dividend yield and 6-8% dividend growth.

Too high of a yield and your risk of dividend cuts increases and too low of a yield and it won’t be enough to live off of in retirement.

My sweet spot is all about finding safe and reliable dividend growth stocks with the right balance of dividend yield and dividend growth.

The post Double Your Dividend Income With Dividend Growth & Triple It With Dividend Reinvestment appeared first on Dividend Growth Investing & Retirement.